CONVENTIONAL, FHA, OR SPECIAL PROGRAMS

Mortgage loans are organized into categories based on the size of the loan and whether they are part of a government program.

This choice affects:

- How much you will need for a down payment

- The total cost of your loan, including interest and mortgage insurance

- How much you can borrow, and the house price range you can consider

Choosing the right loan type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- Majority of loans

- Typically cost less than FHA loans but can be harder to get

- More information below

FHA

- Low down payment

- Available to those with lower credit scores

Special Programs

- VA: For veterans, service members, or surviving spouses

There are two main types of conventional loans:

Conforming loans

Conforming loans have maximum loan amounts that are set by the government. Other rules for conforming loans are set by Fannie Mae or Freddie Mac, companies that provide backing for conforming loans.

Non-conforming loans

Non-conforming loans are less standardized. Eligibility, pricing, and features can vary widely by lender, so it’s particularly important to shop around and compare several offers.

Mortgage insurance is required for some conventional loans.

Conforming

Conventional (conforming)

$484,350 IN MOST COUNTIES

- Most common loan type

- Loan amount must be $484,350 or less in most counties and may be as high as $726,525 in high-cost counties.

- If your down payment is less than 20%, you’ll typically need mortgage insurance

Conforming jumbo

$484,350 TO COUNTY LIMIT

- Conforming loan for amounts higher than $484,350

- Only available in certain counties

- Maximum loan amount varies by county

Non-conforming

Jumbo (non-conforming)

UP TO $1-2 MILLION

- Jumbo loan for amounts greater than the Conforming Jumbo limit in your county, up to $1-2 million

- Rules vary by lender, but usually need good credit and a high down payment to qualify

Non-conforming (other)

- Loans of any size that do not fall into another category

- Some loans in this category are intended for borrowers with poor credit. These loans tend to have high rates and may contain risky features. These can include:

- Loans that allow for minimal documentation of your income

- Loans that allow you to pay only the interest or allow your loan balance to increase

- Some lenders also offer niche programs for mainstream borrowers with unusual circumstances. These can include:

- Loans for properties with non-standard features (such as more than 10 acres of land, properties with agricultural income, or properties that are difficult to appraise)

- Loans for affluent customers with tricky finances, such as self-employed borrowers, or newly graduated doctors

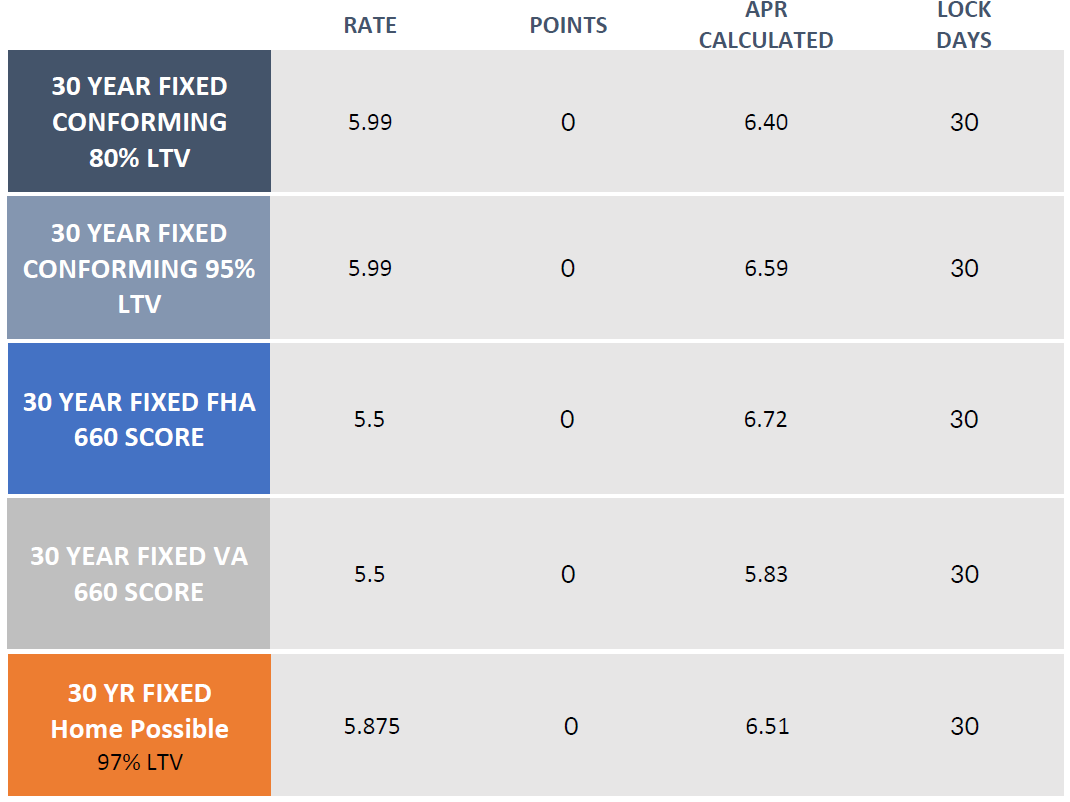

Current Rates

Rates can change anytime. These rates are accurate when they are posted. Please call for up-to-date information.